Table Of Content

It also has the widest array of renovation loans of the lenders we reviewed, including a USDA renovation refinance product. The major difference between a refinance and a loan modification is that refinancing gives you a new mortgage. Modification changes your current terms to add missed payments back into your balance with the goal of helping you stay in your home. A modification should only be considered if you can’t qualify for a refinance and need long-term payment relief. Modification typically has a major negative impact on your credit score. With this type of refinance, your lender replaces your existing mortgage with a loan that has a reduced balance.

Check your rates today with Better Mortgage.

Once you’ve plugged all the numbers into the calculator, you can use the key outputs to determine whether a refinance makes sense. More about that below, but if your closing costs will be $4,800, for instance, and your monthly savings are $200, then you’ll break even in 24 months or two years. If you plan to be in the house well past two years, a refi could make sense. A mortgage refinance is when you take out a new loan—ideally one with better terms—to pay off your current one. Similar to getting your first mortgage, you’ll generally need decent credit, verifiable income and a low debt-to-income (DTI) ratio to qualify for conventional refinancing. Adjust the graph below to see historical refinance rates tailored to your refinance program, credit score, down payment and location.

Pros and Cons of a 30-Year Refinance Mortgage

Here you can see the latest marketplace average interest rates for a wide variety of purchase loans. The interest rate table below is updated daily to give you the most current purchase rates when choosing a home loan. APRs and rates are based on no existing relationship or automatic payments.

Mortgage Refinancing: How It Works and When It Makes Sense

See expert-recommended refinance options and customize them to fit your budget. It’s important to note that this type of refinance could hurt your credit depending on the circumstances surrounding the refinance. Preferred Rewards members may qualify for an origination fee or interest rate reduction based on your eligible tier at the time of application.

If you do use credit cards for rewards and points, try to pay them off immediately—don’t wait for your monthly statement to come in because your score can change daily. It depends not only on your own current financial situation, but also on the general financial climate. When it’s volatile — as it has been since 2022, with interest rates moving up — you might want to hold off on a major move. Gather recent pay stubs, federal tax returns, bank/brokerage statements and anything else your mortgage lender requests. Your lender will also look at your credit score and net worth, so disclose all your assets and liabilities upfront.

Money Talk with Liz Weston: Managing mortgage debt in retirement

You might refinance to a 15-year term to get a better interest rate and pay less interest overall. Once you submit your refinance loan application, your lender begins the underwriting process. During underwriting, your mortgage lender verifies your financial information and makes sure everything you’ve submitted is accurate.

When you’re shopping around, be sure to ask about any discounts—including appraisal waivers—that might be available to you. Some financial institutions offer discounts to existing customers; you might also find military discounts. If you don’t plan to stay for more than a couple of years, you should look closely at the lender’s loan estimates, which will show you the projected five-year cost.

Mortgage Interest Rates Today, April 27, 2024 Are Rates Really Going to Fall in 2024? - Business Insider

Mortgage Interest Rates Today, April 27, 2024 Are Rates Really Going to Fall in 2024?.

Posted: Sat, 27 Apr 2024 10:00:00 GMT [source]

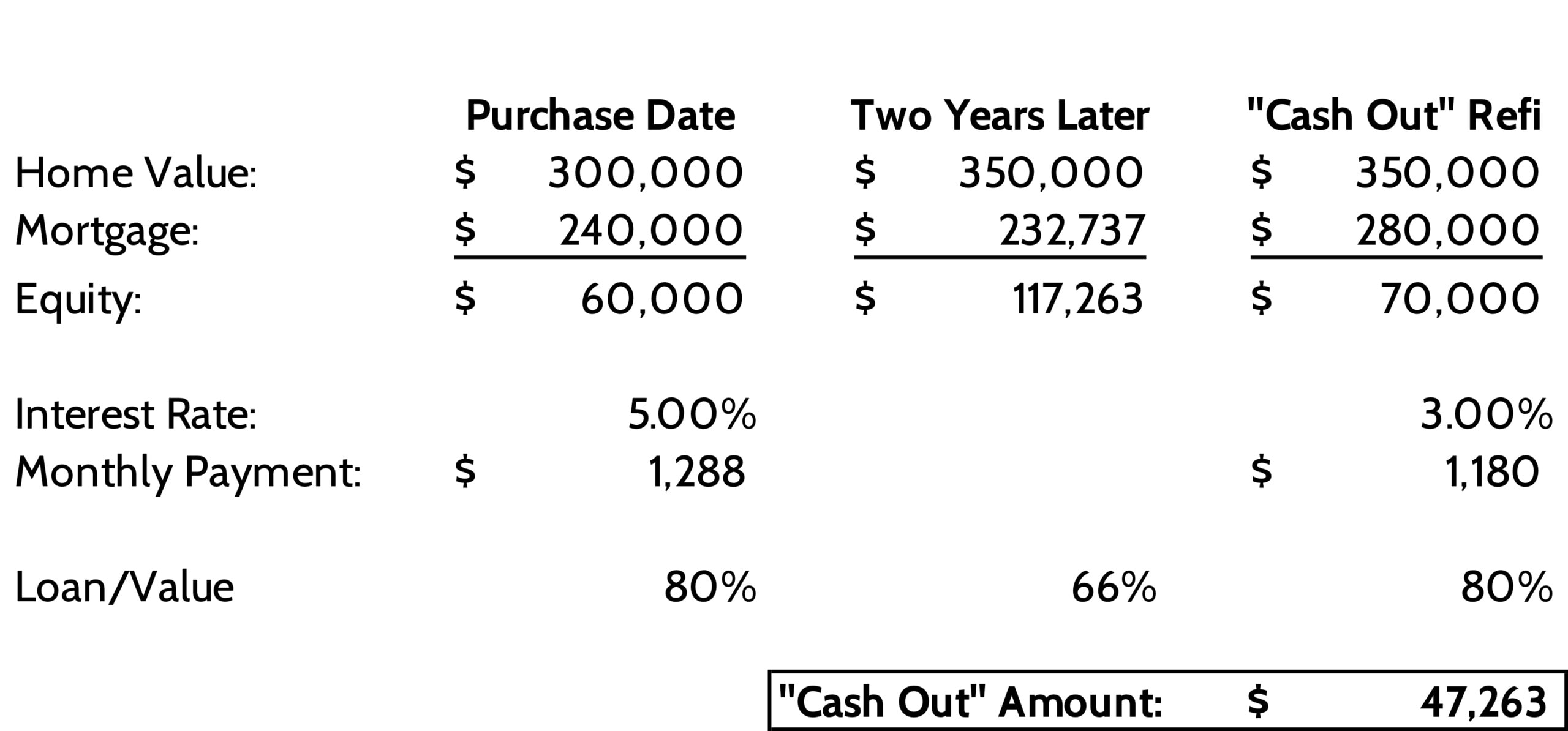

What is a desired cash-out amount?

Mortgage Interest Rates Today, April 26, 2024 Are Homebuyers Adjusting to Higher Rates? - Business Insider

Mortgage Interest Rates Today, April 26, 2024 Are Homebuyers Adjusting to Higher Rates?.

Posted: Fri, 26 Apr 2024 10:00:00 GMT [source]

The closing disclosure and the loan estimate list the closing costs to finalize the loan. Programs, rates, terms and conditions are subject to change without notice. An amount paid to the lender, typically at closing, in order to lower the interest rate. One point equals one percent of the loan amount (for example, 2 points on a $100,000 mortgage would equal $2,000). If you have available equity in your home, you may be able to get cash at closing with a cash-out refinance loan. The slider starts in the red, indicating that the closing costs exceed the interest savings at first.

How do I qualify for a 30-year refinance rate?

Guaranteed Rate offers seven different refinance programs, including a wide variety of fixer-upper refinance programs. A mortgage refinance replaces your current home loan with a new one. Often, people refinance to reduce their interest rate, cut their monthly payments or tap into their home’s equity. Others refinance a home to pay off the loan faster, get rid of FHA mortgage insurance or switch from an adjustable-rate to a fixed-rate loan. The new mortgage you get from refinancing replaces your existing loan, which is an important distinction between getting a second mortgage and refinancing.

The calculator includes interest paid, plus the estimated closing costs. Or, the slider's color might change from red to green and then to orange in this scenario, indicating that you'll save money for a while — before the total payments pile up. This refinance might meet your needs if you'll sell the home within a few years, or if you need rock-bottom monthly payments for a while to meet other needs (to pay tuition, for example). When you refinance a mortgage and start over at the beginning of a new 30-year loan, you're likely to get a lower monthly payment.

Borrowers may also be able to avoid additional home appraisals or inspections on their property during the refinance process. Let’s go over some of the most common types of mortgage refinance options pursued by homeowners, their key features and how to decide which one is the ideal choice for you. A 30-year refinance is when you convert your current mortgage into a new, refinanced mortgage for a repayment period lasting 30 years. Borrowers typically refinance their mortgage to take advantage of lower interest rates or to get a fixed rate rather than an adjustable one. The lowest 30-year refinance rate will largely depend on your financial profile, market conditions and the lender.

The money you tap from your home’s equity can be used to consolidate higher-interest debt or to improve your home. Use Zillow's refinance calculator to determine if refinancing may be worth it. Enter the details of your existing and future loans to estimate your potential refinance savings. Homeowners still have time to lower their monthly mortgage payments by refinancing, as mortgage rates are still relatively low. If you currently have a conventional loan, you won’t be able to switch to an FHA mortgage with this type of refinance. Banks, credit unions and many online lenders offer mortgage refinancing options.

Perhaps you originally got an adjustable-rate mortgage (ARM) to save on interest, but you’d like to refinance your ARM to a fixed-rate mortgage. Refinancing is one way you can use your home to leverage that investment. There are several reasons to refinance, including getting cash from your home, lowering your payment and shortening your loan term. After selecting your top options, connect with lenders online or on the phone. Then choose a lender, finalize your details, and lock in your rate. A 750 score is considered a "very good" credit score, according to FICO.

Refinance rates are based on both factors you can control, like your personal finances, and some you can’t, like the market environment. The whole mortgage refinance process usually takes about 1-2 months. Slightly, but the long-term benefits of refinancing your mortgage can far outweigh the temporary downside. Once you’ve closed on your loan, you have a few days before you’re locked in. If something happens and you need to get out of your refinance, you can exercise your right of rescission to cancel any time before the 3-day grace period ends. Bankrate can help you compare deals and find the best 30-year refinance rate.

But just because lenders offer a certain rate doesn’t mean you’ll necessarily qualify for it. Often lenders will publish their lowest rate available, but those rates are reserved for borrowers who tick several boxes, like holding a high credit score and a low loan-to-value ratio. There should be a good reason why you’re refinancing a mortgage, whether it’s to reduce your monthly payment, shorten your loan term or pull out equity for home repairs or debt repayment. There are many types of refinancing, so consider each within the context of your unique financial situation. Your goal might be to adopt a shorter loan term, or maybe your focus is to lower monthly payments.

But if you're wanting to qualify for the lowest rates, try to get your score at least within the "Very Good" range (740 to 799). If you have a strong credit score, you'll have a better chance of securing a good mortgage rate. Today’s mortgage rates in California are 7.227% for a 30-year fixed, 6.607% for a 15-year fixed, and 8.082% for a 5-year adjustable-rate mortgage (ARM). A no-closing cost refinance is best if you want to refinance but don’t have the cash to cover closing costs. A cash-out refinance allows you to turn your home equity into cash. You’ll refinance your mortgage the same way you would with a rate-and-term refi, only to a bigger loan amount based on how much equity you plan to tap.

No comments:

Post a Comment